Darren Dahl, Contributor

While peanuts and Cracker Jacks have long been associated with the game of baseball, you might not immediately connect peanut butter with America’s pastime. But the gooey spread has actually long been a staple in Major League clubhouses – mainly because players develop a habit of eating it as they make their way up from the minor leagues, where it serves as a cheap and reliable source of protein. Today, you’ll find one brand in particular served up in the clubhouse of every major league team: HomePlate Peanut Butter, a one-year-old startup based in Austin, Texas, founded by two former players and an entrepreneur named Clint Greenleaf. The company’s peanut butter is already sold in some 300 stores with plans to expand to 1,500 by the end of the year with sales topping $1 million.

While peanuts and Cracker Jacks have long been associated with the game of baseball, you might not immediately connect peanut butter with America’s pastime. But the gooey spread has actually long been a staple in Major League clubhouses – mainly because players develop a habit of eating it as they make their way up from the minor leagues, where it serves as a cheap and reliable source of protein. Today, you’ll find one brand in particular served up in the clubhouse of every major league team: HomePlate Peanut Butter, a one-year-old startup based in Austin, Texas, founded by two former players and an entrepreneur named Clint Greenleaf. The company’s peanut butter is already sold in some 300 stores with plans to expand to 1,500 by the end of the year with sales topping $1 million.

I caught up with Greenleaf, who founded and later sold a publishing company, Greenleaf Book Group, and had a conversation that has been edited and condensed about how he got involved in a food startup and how he plans to become a national brand.

Clint Greenleaf

Darren Dahl: How did you get into the publishing business?

Clint Greenleaf: The best way to tell that story is to go back to when I was 15 growing up in Cleveland, Ohio. I was a short, fat kid with bad grades. I knew I needed to change that if I was ever going to get a date with a girl. It was in 1990 when I was in high school where I saw veterans returning from the first Gulf War with girls on both arms. So, when I was accepted to attend Holy Cross, I applied for the ROTC training to become an officer in the U.S. Marines. I was also taking accounting classes, which was the closest thing to a business class the school offered. Before I graduated, I ripped up my shoulder. They told me I would never be a Marine. So rather than serve in a submarine, I became a civilian. I then applied for internships at the Big Six accounting firms. My friends laughed at me because I liked to drink beer and watch TV and they had better grades than me. But I got offers at all six firms, while my friends could manage only one or two offers. They asked me how I pulled that off. I told them my secret was my Marine training: I tied my tie and shined my shoes. Those same friends then goaded me into writing a 28-page book called Attention to Detail: A Gentleman’s Guide to Professional Appearance and Conduct.

Dahl: So you self-published it?

Greenleaf: Yes, I printed up a few copies for my friends and then took out a classified ad to sell the rest at $5 a pop. But within a month I was selling 100 a day, all through the mail. I would go to my PO Box and pull out envelopes filled with $5 checks. It turned out there was a huge need for that kind of modern dress-for-success kind of book. What I didn’t realize at first was that it was a bunch of grandmothers named Gertrude and Rose who were buying the book for their grandsons.

Dahl: How did that experience show you there was a market for self-published books?

Greenleaf: I retired from my accounting job after seven months at the age of 22 because I realized I could make more money selling books. That was 1998. What I came to realize was that people wanted to keep their rights when they published their books. I started what became the first hybrid publisher where we offered authors a combination of publishing services with the ability to own their books. I started working out of my parent’s garage and spent 20 hours a day to get the business launched. It also helped that girls seemed to like going on dates more with publishers than accountants.

Dahl: Your business really took off from there, as you made multiple Inc. 500 lists. But you sold the business in 2011. Why?

Greenleaf: After 14 years of running the company, I saw the landscape changing with the emergence of e-books and the decline of bookstores. I decided then that it would be a good time to sell. We hired a New York investment bank to help us sort out options. We eventually sold to a private equity group who made me an offer I couldn’t refuse.

Dahl: But you stayed on for several more years, correct?

Greenleaf: They were concerned that my name was on the door, and for them it was part of the deal. I stayed on as CEO for 2.5 years and then handed the reigns to the team I had trained. I transitioned to chairman in 2014 and left the company in 2015.

Dahl: How did that lead you to peanut butter?

Greenleaf: It came up when I was having lunch with my buddy, Danny Peoples, who does employee benefits in Austin. He told me he needed me to come and run his peanut butter company. I said, “You don’t have a peanut butter company.” He told me he wanted to start one because there was such huge demand for peanut butter with baseball players. Plus, he was sure I was driving my wife crazy and that I needed to get out of the house during the day.

Dahl: That was enough to get you on board?

Greenleaf: It was a tough sale to try and convince me to do something so different from what I knew. It was a bit of a leap to take. I wanted to get investors and an advisory committee on board before I made any big commitment. Once we had that lined up, it became less of a leap and more of an educated guess.

Dahl: Did it help that the other partner in your business is Ross Atkins, who recently became the general manager of the Toronto Blue Jays?

Greenleaf: Yes, Danny and Ross met playing baseball in the Cleveland Indians minor league system. They knew that minor leaguers make on average $800 a month and lived on peanut butter. But most of what they could buy either wasn’t healthy or just didn’t taste good. Danny and Ross saw an opportunity to provide a healthy alternative peanut butter to those players as they pursued their dreams. Having Ross’s big league connections was clearly a big selling point.

Dahl: What did you do first?

Greenleaf: I started by tapping Scott Jensen, a local friend who started Stubbs Barbecue Sauce and Rhythm Super Foods to find a co-packing facility that could source natural, sustainable, and Non-GMO ingredients to make a no-stir peanut butter that tasted good. That was essential. At the same time, we lined up several former major leaguers as our first investors. Josh Beckett, Mike Lowell, Marco Scutaro, John McDonald, and Brooks Kieschnick all became founding partners in the company. Once we had samples of our product, we reached out to all the clubhouse managers for every Major League team.

Dahl: Was getting your product into those clubhouses was part of your initial marketing plan?

Greenleaf: Yes. The clubhouse managers, or clubbies, are like the team mom. They are in charge of everything from taking care of the equipment to the food. They were the ones going out to the grocery store and buying the giant tubs of peanut butter. But no one wanted to eat the cheap stuff. We gave them a better option that really does taste amazing.

Dahl: So what makes your product different than the rest?

Greenleaf: When people ask us that question, we like to let our product speak for itself. We use the best ingredients and spent a lot of time on our recipe to make sure it tastes like the peanut butter we grew up eating. It’s so awesome to see the look on people’s faces when they try our product. When they say, “Can I have some more please?” we know we’re building something great.

Dahl: Where are you selling your product now?

Greenleaf: We now make and sell three varieties – creamy, honey and crunchy – in Texas in stores like Central Market, Home Goods, and Albertsons. You can also find us online at Amazon.com. We also sell squeeze packs, which are a great way for us to get people to sample our peanut butter.

Dahl: Was it hard for a brand new product to get onto those shelves? There are a lot of other peanut butters.

Greenleaf: Yes, it’s a crowded space with some big players who don’t really like upstarts. Grocery stores aren’t in the business of taking risks, so if they take on a new brand, it’s up to us to cover many of the costs of shelving new products. We expect to spend more than $250,000 this year on marketing our products as well.

Dahl: What do you charge and how does that compare with other peanut butters?

Greenleaf: The suggested retail price is $4 to $5 for a 16-ounce jar. That’s on par with other boutique brands.

Dahl: How did you pick the price?

Greenleaf: We wanted to stay in the same ballpark – Ha! – on price even though our ingredients cost more. As we grow, we hope to bring our costs down to help our margins.

Dahl: Have there been any lessons that you learned from the publishing world that have crossed over into peanut butter?

Greenleaf: There’s been no shortage of tough lessons. It’s really hard to get the flywheel rolling in both businesses, whether that’s getting space at a bookstore or in a grocery chain. It’s about how hard you can work and how much money you can spend to build momentum and remove friction to get that flywheel moving on its own. But I feel like I have a better handle on what I need to pay attention to and what I can ignore.

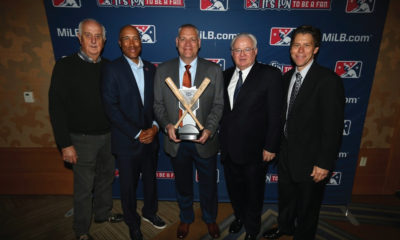

Clubhouse Manager of the Year

Brad Grems San Francisco Giants Home Clubhouse Manager of the Year

Clubhouse Manager of the Year

Gavin Cuddie San Francisco Giants Visiting Clubhouse Manager of the Year